It can be challenging for many people to build a successful investing plan. It is not easy, and it is like developing a hero sandwich. So, here, one must always stick to the basic ingredients and meantime they should not be too fancy. Most of the investors think that there will be some secret recipe that will help them in succeeding. But some people never had any secrets but succeeded in the big market. It is very important that investors always adhere to the basic principles. So, these are the basic ingredients which can help them to move towards irrespective of where the market is heading.

Being an investor, one must always think of finding the best ingredients which can bring them healthy gains over the period. For this, he should select a proper mix of assets. So, for example, at a point in time, he should be clear that he should go for stock or a mutual find. Meantime it is very important for an investor to keep his investments very simple and his cost as low as possible. It is very important for people to start saving when they are at a young age. This will help them in grabbing a sophisticated future.

Diversification – A key to success

It is always a good idea to spread the investments. So, diversifying can help in increasing the chances of one or other investments always performing well when some others are not in good condition and struggling. Another idea can be perfectly time market, but this is not easy for everyone. So, it is better to diversify the investments which can play a better role.

One must always think their investments as a smorgasbord. It is a very good idea to spread the investments among bonds, stocks, and any other assets. This process can also be called asset allocation. Even though there will always be some confusion about either to sell or buy some fund or stock, there are some researches which have already proved that asset allocation will explain all these ups and downs. Some percent will remain, and they should be handled through market timing and security selection. When it comes to stocks, investors should always think of considering investment styles, which are different. They should also consider industries, company sizes, and even countries. When we think of bonds, they should choose ones with different levels of credit risk and varying maturities.

In most of the cases, for investors, it becomes challenging to spread their asset beyond their country. This is because there will always be a tendency to favor one’s own country. When it comes to divvying the investments, the best formula which can be used will be based on investor’s age, his risk tolerance, and even his goals in investments. Experts suggest that investors who are interested in individual stocks always invest in at least 10 and should not go beyond 30.

When we think of bonds, investors always should think of diversifying them based on their degree of credit risk. If the investor is holding most of the corporate debt or municipal bonds, then he should think about spreading it at least among ten issuers. If it is junk bonds or in case emerging market debts, then he should be using exchange-traded fund or mutual fund.

Keeping balance

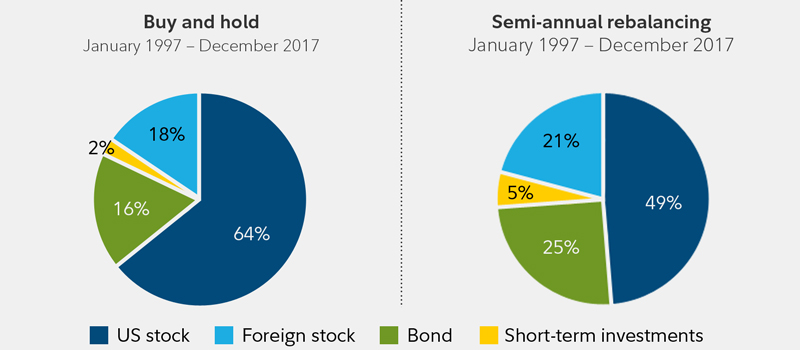

Researches show that most of the investor’s portfolio suffers because of negligence. So, there is a process called rebalancing, which is very necessary for the investors. This is nothing but regular maintenance of the portfolio, which can reshuffle assets for making sure that they are reflecting the division which is chosen by the investor. This rebalancing process can help in minimizing the risks. Along with this, it can also help to keep the investor on track with the right allocations, which are appropriate for his goals.

Rebalancing is the process which works through trimming the assets groups. These are the assets groups which are performing comparatively well and are helping in adding to the holdings which are relative laggards. For most of the investors, this rebalancing can be an administrative chore which seems like ho-hum. But this is the process which fights with his emotion. It is always not easy to cut back on the regular and biggest winners. But it is necessary to do that otherwise it can increase the risk associated with those holdings.

Clockwork Investing

For most of the investors, it can be daunting when it comes to deciding what to invest in. So, it is better to adopt a practice called dollar- cost averaging. This helps even a no-brainer to invest in. This is a strategy wherein people should invest the set amount regularly either monthly or quarterly. This helps in avoiding harmful and risky behavioral inclinations.

Once the investor enters the market, this averaging can also help him with sticking to his plan. Even though he puts everything in the market, it is good that he will understand how much he will lose when he invests at the wrong time. Investing based on the intervals can remove the fixed reference points, which usually keep the investors from getting paralyzed by the hatred that he should lose money. When dollar cost averaging is followed, there will not be any second guess left for the investor, and this is the beauty of this strategy. It also helps in reducing the per share cost of the stock holding and makes sure that investors will always buy more and more shares when the price is reduced and lesser when the prices go up.

Cutting the costs

There are few things which are disclosed by investments, and some of them are dividends and capital gains. But investors never see the tidy sum of fees which he is paying. This is very important because when he does little digging, he can predict as well as manage all his expenses. But meantime, he should always understand that he will always have very little control on the returns. One thing is sure that when he spends less on the fees, he can gain more returns.

It is very important that he should start the trimming by fat fund fees which he is paying currently. Usually, investments funds slice a little bit off through deducting the management fees. It is very important to look at the annual expense ratio of a fund, which helps in revealing the total fund charges.